On November 25, 2021, Eritrea became the 50th African country to sign a memorandum of understanding to join the China Belt and Road Initiative (BRI).

But the relationship between China and Eritrea is an old one that can be traced back to 220 AD when ancient imperial China imported hippopotamus, turtle, and elephant tooth from Adulis port.

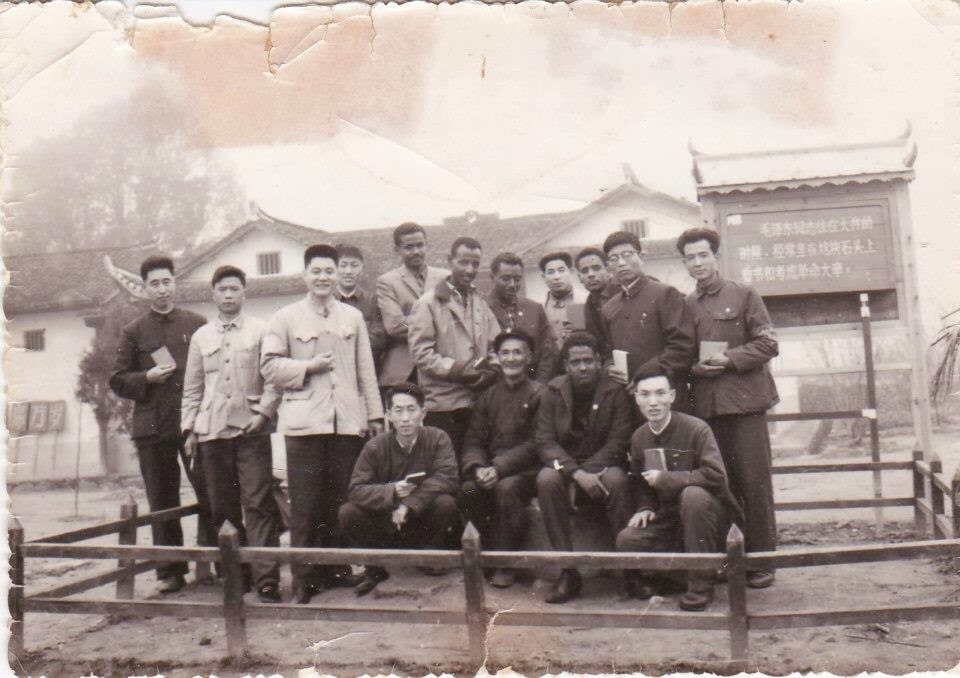

In the 1960s, China welcomed African students to study inside their country as part of the Chinese Communist Party’s global communist revolution.

The Chinese Communist Party worked with both Eritrean liberation fronts by providing military training and small weapons and ammunition during Eritrea’s war for independence. China continued to support Isaias Afwerki during his war with Ethiopia in the late 1990s.

Before Eritrea’s arms embargo in 2009, and in 2017, China offered to help settle disputes between Isaias and neighboring country Djibouti as China has billions of dollars investments in Djibouti’s ports and railways.

In 2018, China paid US $1.8bn to take over Nevsun’s gold and copper-rich Bisha mine investment.

China also helped to broker the peace contract between Eritrea and Ethiopia in 2018. China has over US $17bn invested in Ethiopia.

China’s dilemma of international intervention

In 1990, close to the end of the Cold War, Deng Xiaoping shared the message of China’s future foreign policy plan: “Observe calmly,” he cautioned, “secure our position; cope with affairs calmly; hide our capacities and bide our time; be good at maintaining a low profile, and never claim leadership.”

The interpretation of his meaning is often debated. Still, many believe the overall idea was to avoid following, past European powers, and previous Asian powers, down the path of global hegemony. Or better disguising its plans of global imperialism.

In 2008, China made up more than 80% of the United Nations’ global peacekeeping operations, with nearly 75% of their police, troops, and military observers stationing in various parts of Africa: Sudan, DR Congo, Liberia, Côte d’Ivoire, and Western Sahara.

By 2015, China completely revamped its foreign policy to better serve its global interests by expanding its military presence in foreign countries and waters.

China has mimicked its western counterparts in the last decade, continuously expanding its global military presence in unison with its BRI.

Most staunch Isaias supporters argue China is better suited for Eritrea than the west because China has “Eritrea’s” best interests in mind. Isaias and his sycophants likely prefer China’s foreign policy because China will turn a blind eye to Isaias’s gross human rights violations.

A recent example of Isaias’s troubles with, and eventual loss of, a promising western investment comes from the European Union’s failed 2016 EUR $200mn road project in Eritrea.

The project was heavily criticized by Eritrean activists worldwide because of the obvious likelihood that conscripted laborers would be used to build the roads from Assab to Ethiopia. Still, the EU cared more about creating opportunities they thought would help prevent Eritrean migration into its countries.

Disbursements were delayed and eventually abruptly halted in 2021 after Eritrea failed to provide adequate financial reports, but mainly because Eritrea was exposed to its supporting role in the war in Ethiopia.

All remaining funds from the project’s first phase were redistributed to aid refugee camps in Sudan, fight famine in South Sudan, and support displaced migrants across the region.

At the same time, China invested roughly US $186mn into road and energy projects from Massawa and Assab to Ethiopia, competing against the EU’s investment project.

Roads from Eritrea’s seaports are vital for China’s industrial park investments in Ethiopia. They will allow for easy export through the Red Sea, where 10% of all global trade passes annually.

Military ports in Eritrea’s Red Sea will also be vital for protecting China’s interests. One could say the China-Eritrea BRI has been unofficially underway since 2017.

On January 6, Silk Road Briefing reported that China and Eritrea are aligned in their support of Prime Minister Abiy Ahmed in his fight against Tigrayan forces. China has always prided itself on never taking sides.

In these ways, China aligns well with Isaias and the ruling PFDJ. Isaias has kept Eritrean civilians suppressed for 30 years (e.g., no constitution, parliament, courts of justice, etc.). Close to zero internet penetration has granted him unimpeded control over information coming in and out of the country.

(It should be noted that, in small increments, Eritrean opposition members have successfully used various telecom channels to reach Eritrean citizens)

The China debt-equity swap

Between 2000 and 2018, China’s total loans to Africa reached roughly $148bn, mostly in large-scale infrastructure projects focused on transportation and energy sectors. In 2021, that figure grew to over $200bn.

It should be noted that China’s predatory lending practices are often overblown. China granted deferrals to its lowest-income borrowers due to the pandemic in 2020 and 2021 but has never forgiven any debts. For the first time since 2000, China has decreased its Africa investments.

However, many still believe China’s BRI is expanding its production and sourcing infrastructure into foreign countries, which offer cheaper energy and worker costs, to increase its global influence and military presence.

Though development projects are a great sign of a countries growth initiatives, low-income countries can easily get trapped in never-ending debt cycles when said developments don’t pan out.

In the case of China, many of these cycles have ended in debt-equity swaps, where China seizes state assets (e.g., seaports, airports, oil, agricultural land, etc.) in exchange for debt relief.

China has been heavily criticized for its lending practices to countries that struggle with loan repayments.

What’s most problematic is that none of the contracts are public. Recipient government citizens are not privy to their leaders’ agreements and often cannot hold these leaders accountable for their actions.

In Uganda, lawmaker and head of parliament Joel Ssenyonyi exposed the details and fine print of the 17-page US $200mn loan agreement between China and Uganda’s president in 2015. The project was set to improve the Entebbe International Airport.

More criticism of China’s “debt traps” rose as auditors found the loan agreement included clauses related to escrow and a waiver of sovereign immunity, making China the main decision-maker over Uganda’s government budget.

Uganda has borrowed roughly US $6.6bn for railway and road projects. At least four more loans have the same clauses.

Other examples include:

- Myanmar — US $9 billion or 14 percent of Myanmar’s GDP – risks losing Kyaukpyu port.

- Kenya — US $50bn 72% of the country’s external debt – risks losing Mombasa Port.

- Pakistan — US $62bn or 20% of GDP – lost parts Guwad port for 43 years.

- Sri Lanka — US $1.5bn or 10% of countries GDP – lost Hambantota Port for 99 years.

In other states that already have high external debt or rely excessively on direct Chinese investment — such as Djibouti, Laos, Tajikistan, Kyrgyzstan, and Montenegro — Beijing has used different forms of restructuring measures, e.g., acquiring the recipient country’s natural resources or long-term oil contracts to offset the loans.

On January 6, 2022, China’s Foreign Minister Wang Yi denied these claims ahead of his tour to Eritrea, Kenya, and Comoros, stating:

“That is simply not a fact. It is speculation being played out by some with ulterior motives. […] This is a narrative that has been created by those who do not want to see development in Africa. If there is any trap, it is about poverty and underdevelopment.”

In another statement, China Foreign Minister Wang Winben states:

“All loan agreements were signed on voluntary basis […]. The so-called detention or takeover of projects or assets by China’s financial institutions are purely made up out of malicious intent without any basis. In fact, there is no project that has been taken over by China due to debt issues[…].”

Government bonds and sovereign creditworthiness

Governments, like individuals and corporations, have credit ratings or credit scores. These ratings determine interest rates or yields on government-issued bonds. You can think of bonds as loans that a government issues out or sells to investors.

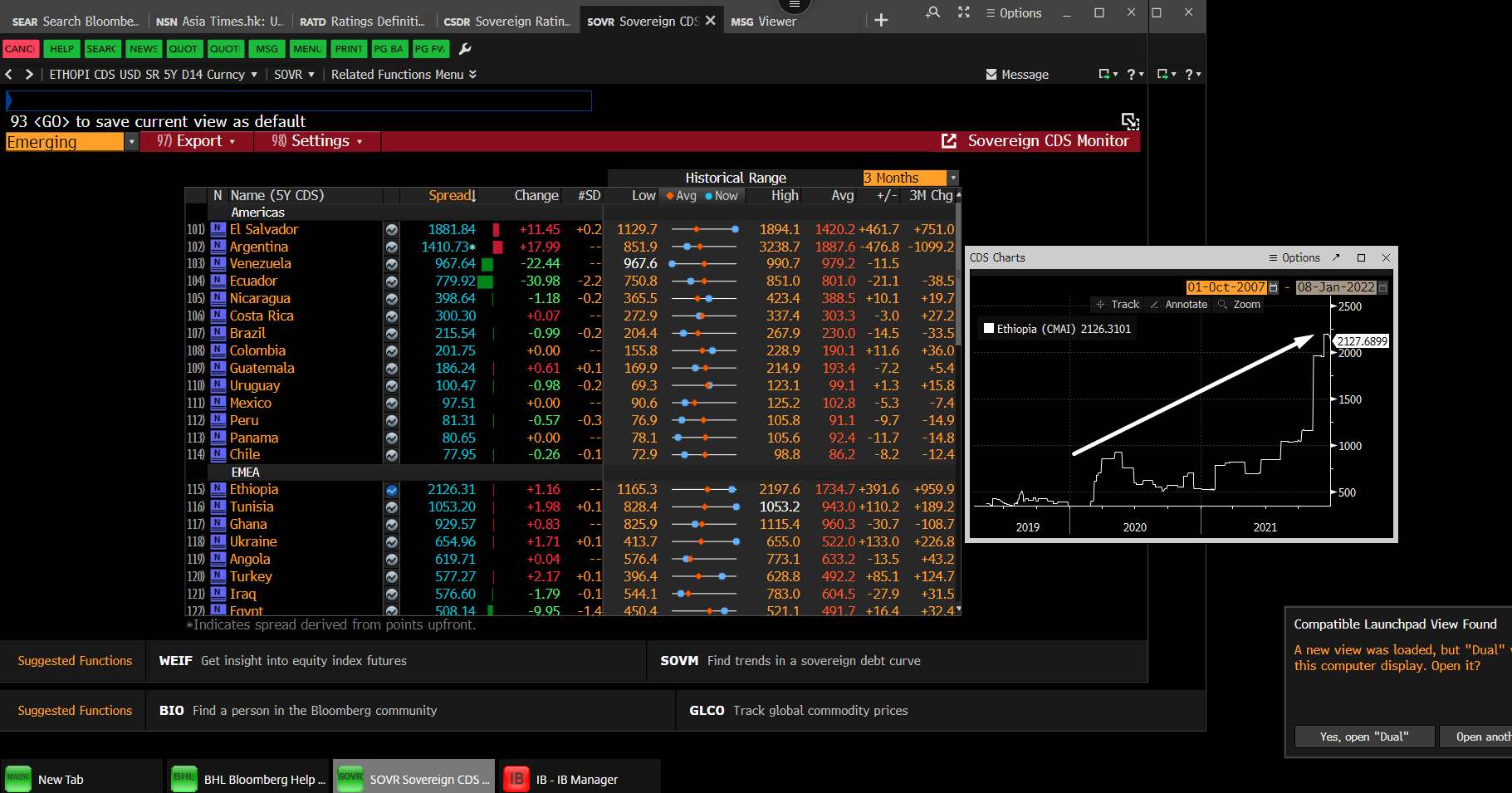

These investors can be private businesses, banks, etc., or public sector, government investors, e.g., China, U.A.E., Turkey, etc. A country’s credit default spread (CDS) indicates the country’s likelihood of default. The higher the spread, the more likely they are to default.

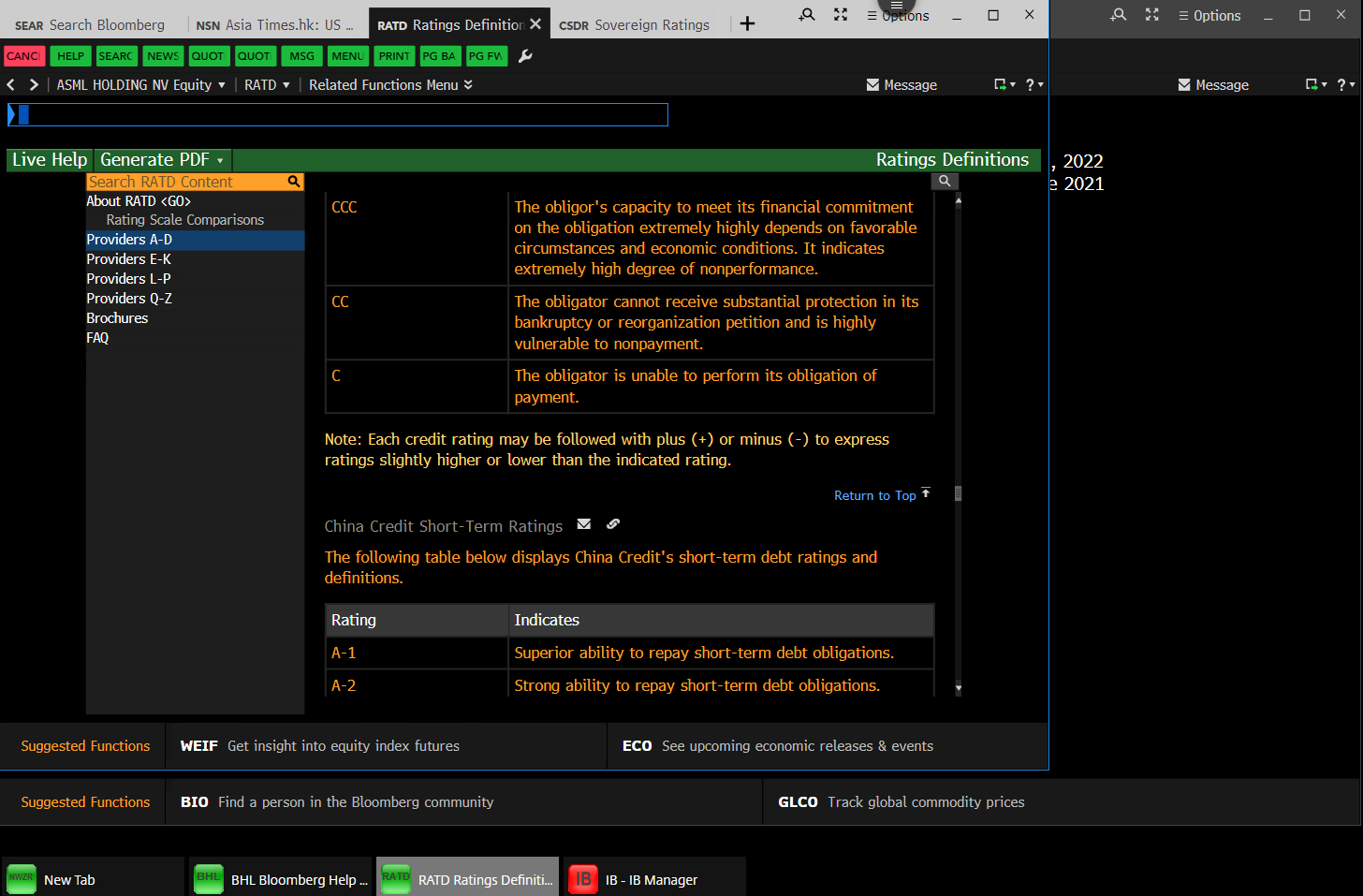

Several credit rating agencies rate bonds (Moody’s, S&P, Fitch, R&I, etc.). Each has a rating system, usually starting with “A” as the highest rating and “D” for “default” as the lowest rating. These agencies rate a country’s creditworthiness, affecting the price and interest rates on loans.

Since Eritrea does not disclose any financial reports, we’ll take a look at the creditworthiness and CDS of Eritrea’s neighboring country and partner in crime, Ethiopia, for this example (data captured via the Bloomberg Terminal on Jan 8, 2022):

One of the main reasons Ethiopia’s CDS is currently the world’s highest, which can be seen in the CDS timeline graph, is that Ethiopia has been in a war since 2020. Other factors include, but are not limited to COVID-19, civil unrest, inflation, jobs, trade deficit, previous repayment performance, etc.

In the fourth quarter of 2021, the S&P downgraded Ethiopia’s credit rating from a “B-” to a “CCC.” The China Credit Rating Co., Ltd. (CRCC), defines a CCC rating as:

“The obligor’s capacity to meet its financial commitment on the obligation extremely highly depends on favorable circumstances and economic conditions. It indicates extremely high degree of nonperformance.”

According to S&P, countries with a “CCC” rating have a 94% chance of defaulting on their loans within ten years. By their standards, the S&P and CRCC would currently rate Ethiopia as a “non-investment grade,” “high yield,” “speculative,” “junk” investment.

Along with Ethiopia’s removal from the AGOA, these factors likely contributed to the war’s recent de-escalation and Abiy Ahmed’s change of tone towards Washington.

Some would argue that the U.S. is deliberately destabilizing Ethiopia in hopes of squandering China’s investments, which would make sense if China didn’t stand to gain control of state assets upon the borrowing country’s default.

China has invested over $17bn in Ethiopia as part of their BRI. One advantage Ethiopia has over other African countries is its population size, human capital, and ability to tax citizens.

Ethiopia’s recent adoption of the Cardano blockchain for digital payments would certainly help track all payments/transactions. However, the project is still in its infancy, and Ethiopia still rates poorly as Abiy Ahmed has failed to stabilize his country.

Eritrea’s creditworthiness

Before the BRI agreement, Eritrea defaulted on a Qatar loan valued around US $300mn, and was impacted by supply chain disruptions due to 2020 and 2021 COVID lockdown measures. Isaias made matters worse by declining vaccine aid and joining the war in Ethiopia against Tigray.

The most extreme forms of inflation happen during times of war. Countries will print or borrow money to support troops with weapons, ammunition, auto, and other forms of military support. Here is a list of historical wars and the inflation that followed:

- 1861-1865 US Civil War = 117% inflation

- 1917-1918 US WWI = 126% inflation

- 1941-1945 US WWII = 108% inflation

- 1945 Germany = 24,380% inflation

- 2008 Zimbabwe = 89.7 sextillion % inflation (multiplying every hour)

As inflation continued to rise, Eritrea officially joined China’s BRI to aid its recovery and gain additional outside investment. The terms of their agreements are not public. China’s investments may be greater than 10% of Eritrea’s GDP.

Eritrea’s human development index, which calculates a population’s average longevity, education, and income, value for 2019 was 0.459 — which puts the country in the low human development category — positioning it at 180 out of 189 countries and territories. In 2018, Eritrea’s experienced a massive exodus from its working class.

Eritrea’s unemployment rates were recorded near 11% in 2019 and likely increased drastically between 2020 and 2021. Lower remittance inflows globally also devastated Eritrea as remittances make up a significant percentage of its GDP.

Eritrea is rich in natural resources (e.g., gold, copper, potash, etc.); however, developments have struggled due to poor leadership. There is a very high likelihood that Eritrea has a “high yield” or “non-investment grade” credit rating. It would be interesting to see Eritrea’s actual creditworthiness and CDS ratings.

One of the extremely dark advantages Isaias has always had in attracting outside investors is his ability to control the people inside of Eritrea and the extremely low-cost or free labor provided by indefinite conscription. Eritrean civilians have been made slaves to grow Isaias’s power.

Isaias’s age and signs of trouble

Normally, adults grow to be more compassionate as they age. Because they experience more compassion, empathy, and tolerance, older adults tend to be better at solving problems involving other people.

So, as a rule, leaders of a region, community, or family who are older might be better at the negotiating table in terms of negotiating treaties because they are better at seeing the other person’s perspective. We see this a lot throughout various cultures and communities.

However, this is not the case for autocratic leaders, dictators, strongmen/women, or totalitarians. These leaders have been corrupted by power and are usually diagnosed as psychopaths.

These leaders tend to be surrounded by sycophants who tell them what they want to hear, either because they are afraid or because they want that leader to share power with them.

In Isaias’s case, we see the latter. Isaias is a leader that has proven time again that he wants what’s best for himself and has developed a variety of tricks to fool his followers into thinking they can trust him.

At age 75 and with recent health scares, many speculate that Isaias’s agreement to join China’s often one-sided BRI is a sign of more reckless borrowing.

Like world leaders that choose to ignore climate change and its impacts on future generations, Isaias may not be around to see the consequences of his actions.